A borrower requests an extension? kennek's...

✅ Restructuring loans doesn’t need to be painful! When a borrower requests an extension — whether...

Read more

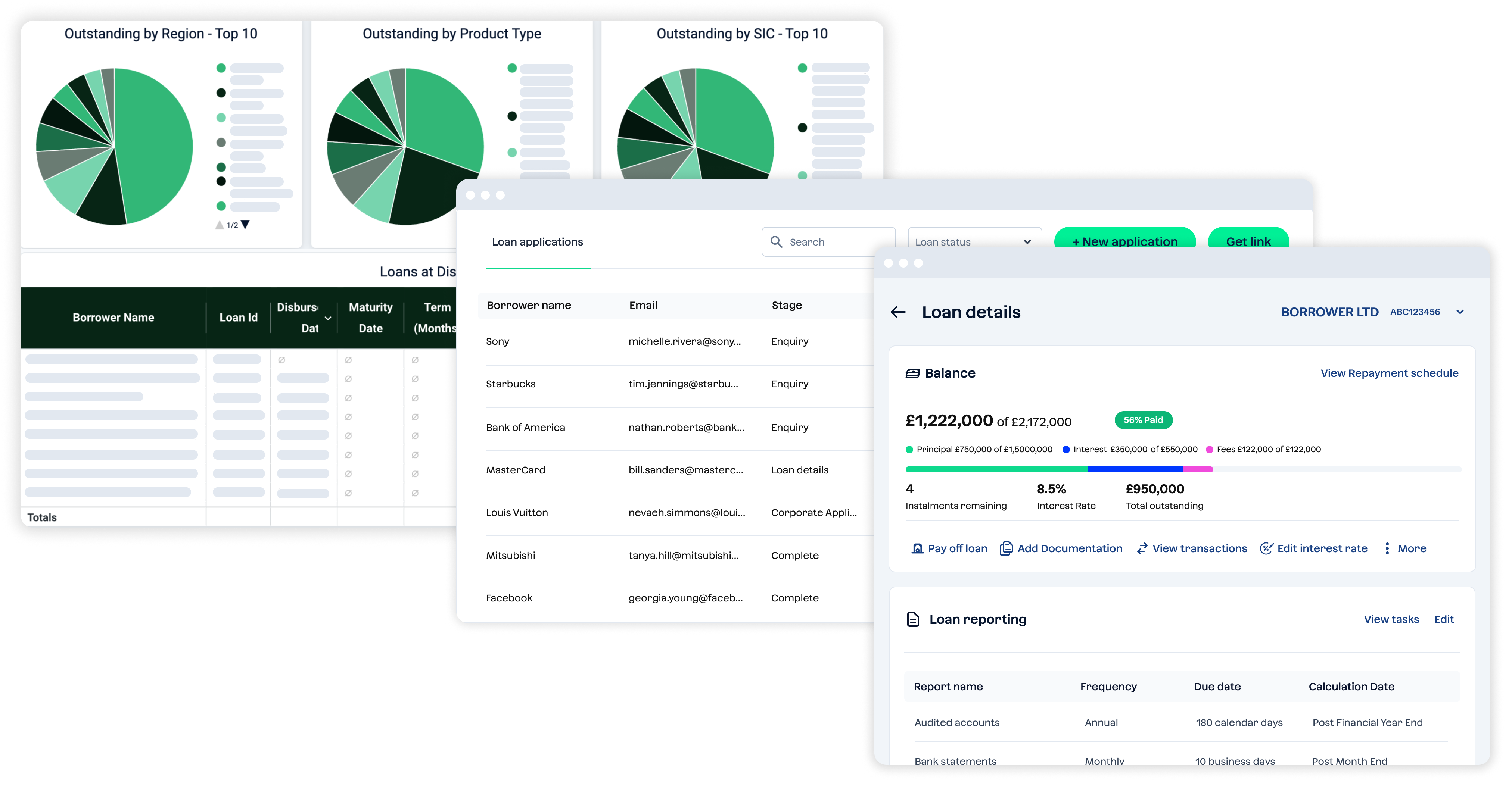

In the fast-paced world of UK bridging and development finance, lenders face mounting pressure to streamline operations, mitigate risks, and scale efficiently. Traditional loan management systems often fall short, burdening teams with manual processes and fragmented data. Enter kennek—a modern, AI-powered loan management platform designed specifically for the unique needs of property finance lenders.

kennek offers a comprehensive suite of tools that cover every stage of the lending process:

Origination & Underwriting: Automate data extraction, credit scoring, and risk assessment to accelerate decision-making.

Servicing & Monitoring: Gain real-time insights into loan performance with customizable dashboards and automated covenant tracking.

Investor Reporting: Provide stakeholders with transparent, real-time updates on loan portfolios.

This unified approach eliminates the need for multiple disparate systems, reducing complexity and enhancing efficiency.

In an environment where Non-Performing Loan (NPL) ratios are on the rise, proactive risk management is crucial. kennek leverages artificial intelligence to:

Monitor loan performance in real-time.

Identify early warning signs of potential defaults.

Automate intervention protocols when risk thresholds are breached

This proactive approach enables lenders to address issues before they escalate, safeguarding their portfolios.

kennek enhances user experience through:

Borrower Portal: Allow borrowers to manage payments, track loan status, and receive notifications.

Investor Portal: Provide investors with access to performance metrics, reports, and compliance documents.

These portals foster transparency and strengthen relationships with both borrowers and investors.

As the UK bridging finance market continues to grow—now exceeding £10.3 billion—lenders must scale efficiently. kennek's cloud-based platform allows lenders to:

Expand their loan books without proportionally increasing headcount.

Automate routine tasks, freeing up resources for strategic initiatives.

Adapt to market changes swiftly with configurable workflows and settings

kennek's team comprises former lenders who understand the intricacies and challenges of the industry. This insider perspective ensures that the platform is not only feature-rich but also intuitive and user-centric.

While other loan management systems such as Aryza, Riskfree, Lendfusion, Hypercore, and nCino offer modular or general-purpose solutions, kennek’s USP is its end-to-end, lending softwre tailored specifically for UK bridging and development lenders. Competitors may require multiple integrations, focus on broader banking or SME markets, or lack flexibility in their loan engine and loan products behaviors. kennek combines lifecycle coverage, intelligent risk management, and real-time data, analytics and reporting all in one platform.

| UI | functionality | price | support | ICP | |

| Aryza | modern, modular | strong automation tools; requires integration for full workflow | mid-high; enterprise pricing | responsive enterprise-level support | Financial institutions & consumer lenders – Europe & Australia |

| Riskfree | dated but functional | strong document and payment tools; limited automation | mid-range; modular pricing based on users | UK-based, smaller support team | Bridging & short-term lenders – UK |

| Lendfusion | simple and clean | good servicing & reporting; fewer origination tools. Limited loan engine | affordable; SME-focused pricing; scalable by volume | good self-service resources | SME and alternative lenders – Eastern Europe & Baltics |

| Hypercore | clean, data-focused UI | excellent analytics; limited full-cycle lending tools | variable (usage-based) | smaller, tech-driven support team |

Small lenders & fintechs – US & Global |

| nCino | enterprise-grade UI | highly comprehensive but complex to deploy | high; bank-level SaaS; implementation costs often £100k+ | extensive enterprise support | Banks & large financial institutions – US & Global |

| kennek | intuitive, lender-designed | full lifecycle coverage; strong AI-driven risk monitoring | competitive small and mid-tier; scales with loan book size; all-in-one solution | dedicated, UK-based team, with credit expertise | Bridging, development & property finance lenders – UK & Europe |

For bridging and development lenders seeking a modern solution to manage the complexities of property finance, kennek offers a robust, all in-one platform that streamlines operations, mitigates risks, and enhances stakeholder engagement. Its end-to-end capabilities and lender-centric design make it a standout choice in the competitive landscape of UK specialist lending.

✅ Restructuring loans doesn’t need to be painful! When a borrower requests an extension — whether...

Read more%20(3).png?width=365&name=Flexible%20loan%20engine%20(1)%20(3).png)

In today’s lending environment, relying on Excel spreadsheets and manual workflows is becoming...

Read more

In the fast-paced world of UK bridging and development finance, lenders face mounting pressure to...

Read more