A borrower requests an extension? kennek's...

✅ Restructuring loans doesn’t need to be painful! When a borrower requests an extension — whether...

Read more

✅ Restructuring loans doesn’t need to be painful!

When a borrower requests an extension — whether due to unsold units, supplier delays, or short-term cashflow stress — what happens next?

For most lenders, it triggers hours of manual work:

📊 endless spreadsheets

📧 messy email chains

📉 risk of errors

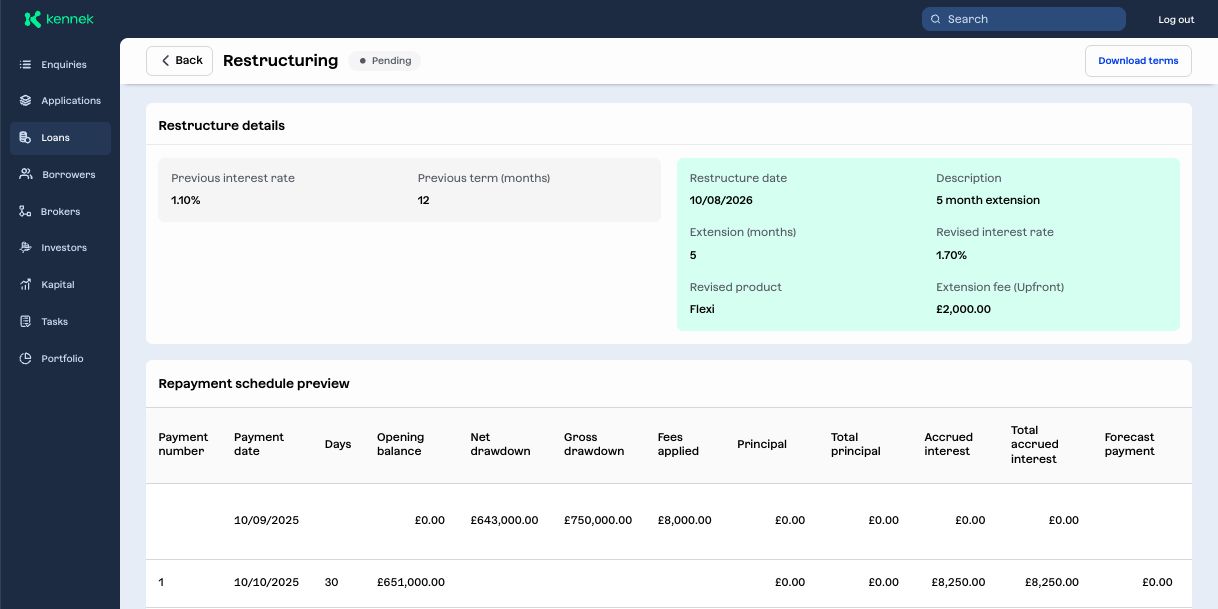

With kennek’s loan restructuring feature, you can transform this process:

🚀 Manage extensions with new terms, fees, or revised rates — seamlessly

✅ Eliminate Excel risk of errors with centralised, auditable data

🔍 Ensure full credit control with transparent workflows and automated repayment schedule updates

The result?

Less admin. More control. Better outcomes.

Your team focuses on making the right credit decisions, not wrangling spreadsheets.

📈 Protect portfolio performance

🤝 Support borrowers

🕒 Save hours on restructuring

👉 Want to see it in action?

Let’s book a quick demo — we’ll show you how our complete lending software help you restructure loans in minutes, not days.

✅ Restructuring loans doesn’t need to be painful! When a borrower requests an extension — whether...

Read more%20(3).png?width=365&name=Flexible%20loan%20engine%20(1)%20(3).png)

In today’s lending environment, relying on Excel spreadsheets and manual workflows is becoming...

Read more

In the fast-paced world of UK bridging and development finance, lenders face mounting pressure to...

Read more