“Efficiencies from a system like kennek will mean that we can grow quite extensively without adding extra wages"

Jonathan Sealey

CEO Hope Capital

“As with everything, you guys usually over deliver, which is beautiful"

Neil Pool

Head of Compliance Bluecroft Finance

"We chose kennek because it offered an end-to-end platform that could scale with us and meet our future institutional reporting requirements, without the delays and risks of building internally”

Kobi Lehrer

CEO Proxima Capital

“We chose kennek for their lending expertise. Their loan management and works seamlessly, and it’s running extremely well”

Dominick Peasley

CEO SPRK Capital

"Aside from helping get our processes in order, we’ve been through a large diligence process around how we are funded and are at a stage where kennek have introduced different funding lines to us and brought their expertise beyond software to benefit Tower Grange Finance. We’re proud to be partnering with them and excited by what else is to come"

Stephen Sullivan

Co-Founder & CEO Tower Grange Finance

“The organisation has been great… we see the changes happen almost before our eyes”

Amanda Benstead

Asset Manager, Bluecroft Finance

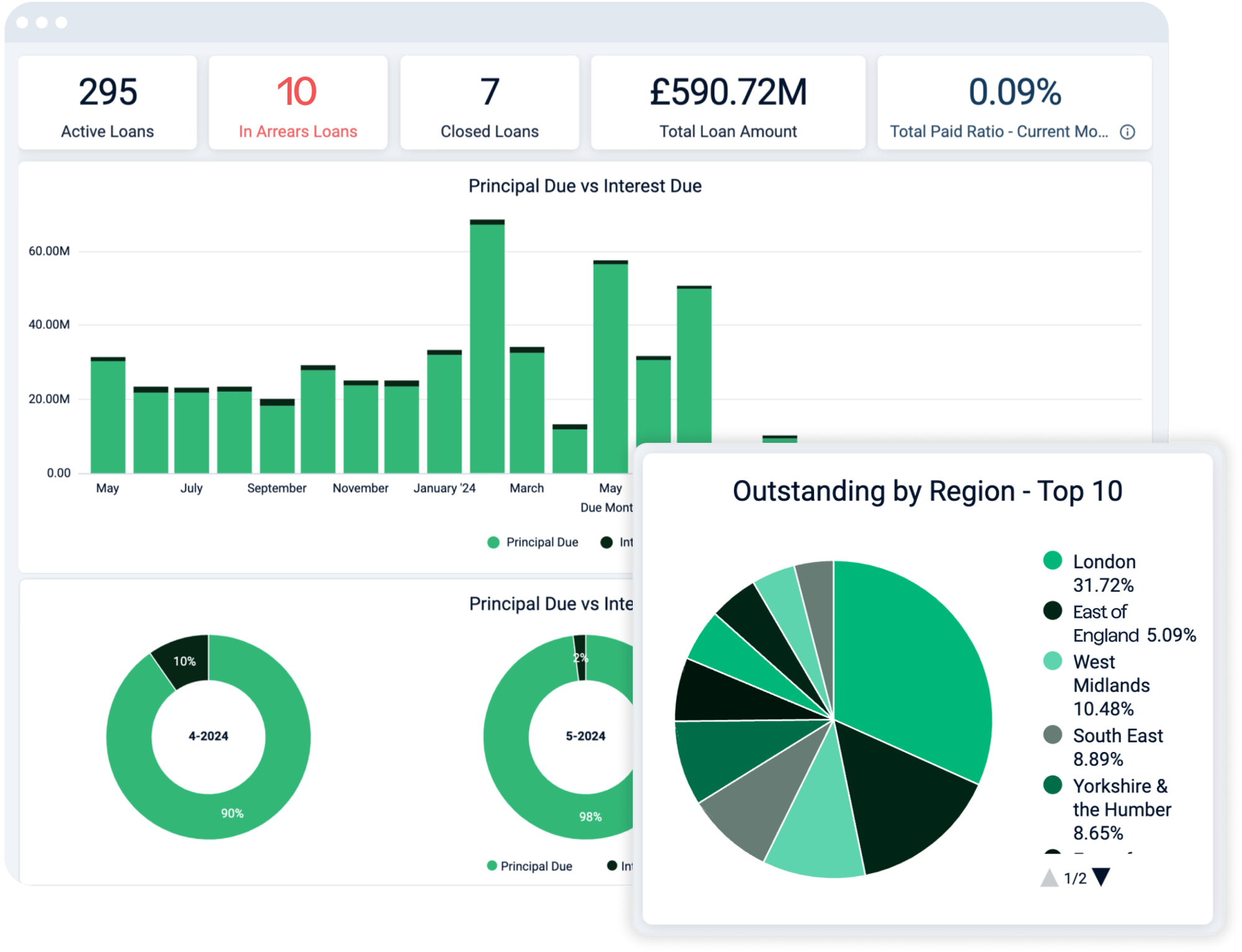

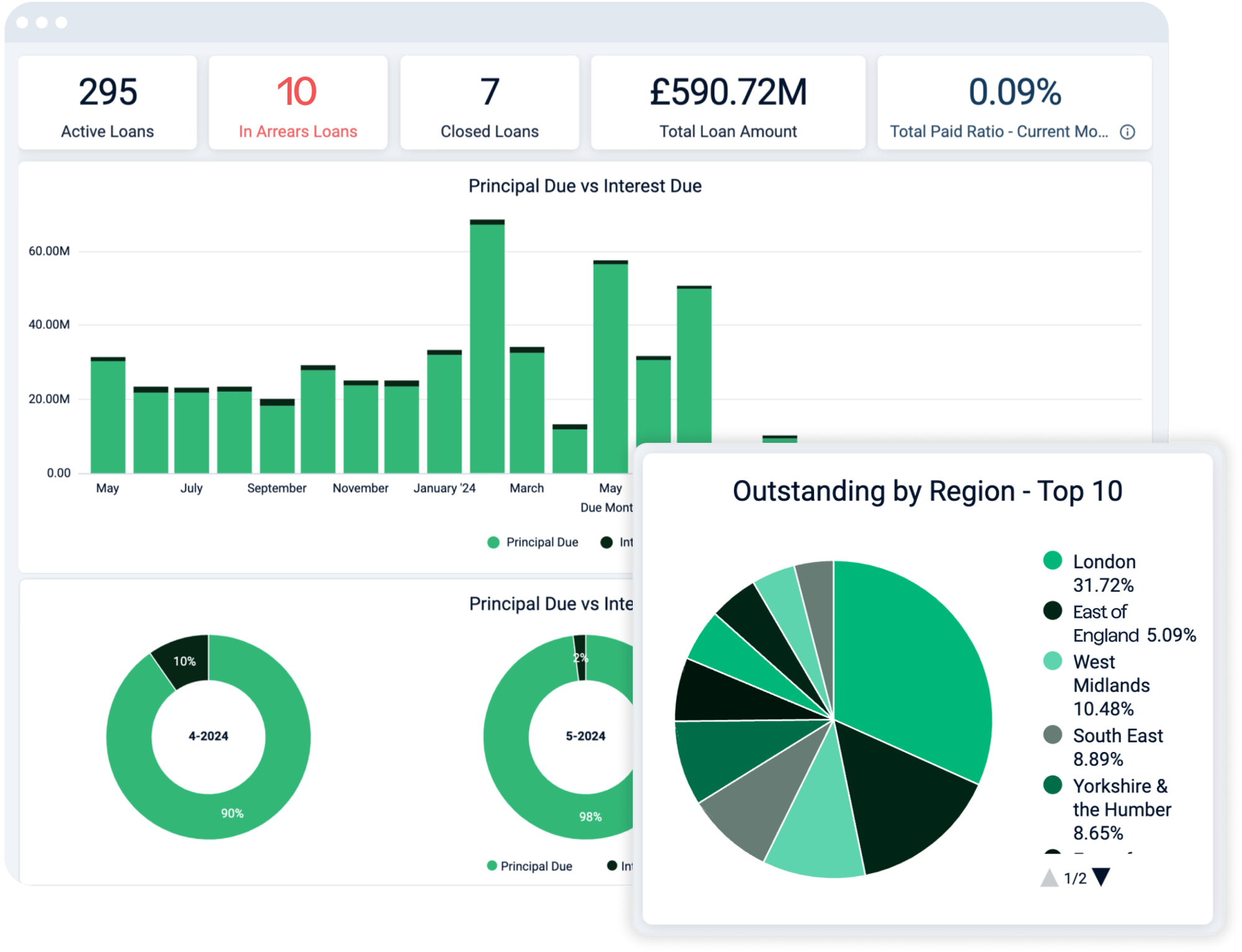

Loan portfolio analytics

- Holistic view of your loan portfolio data

- Detailed portfolio dashboard

- Real time data tracking

- Automated export of key metrics

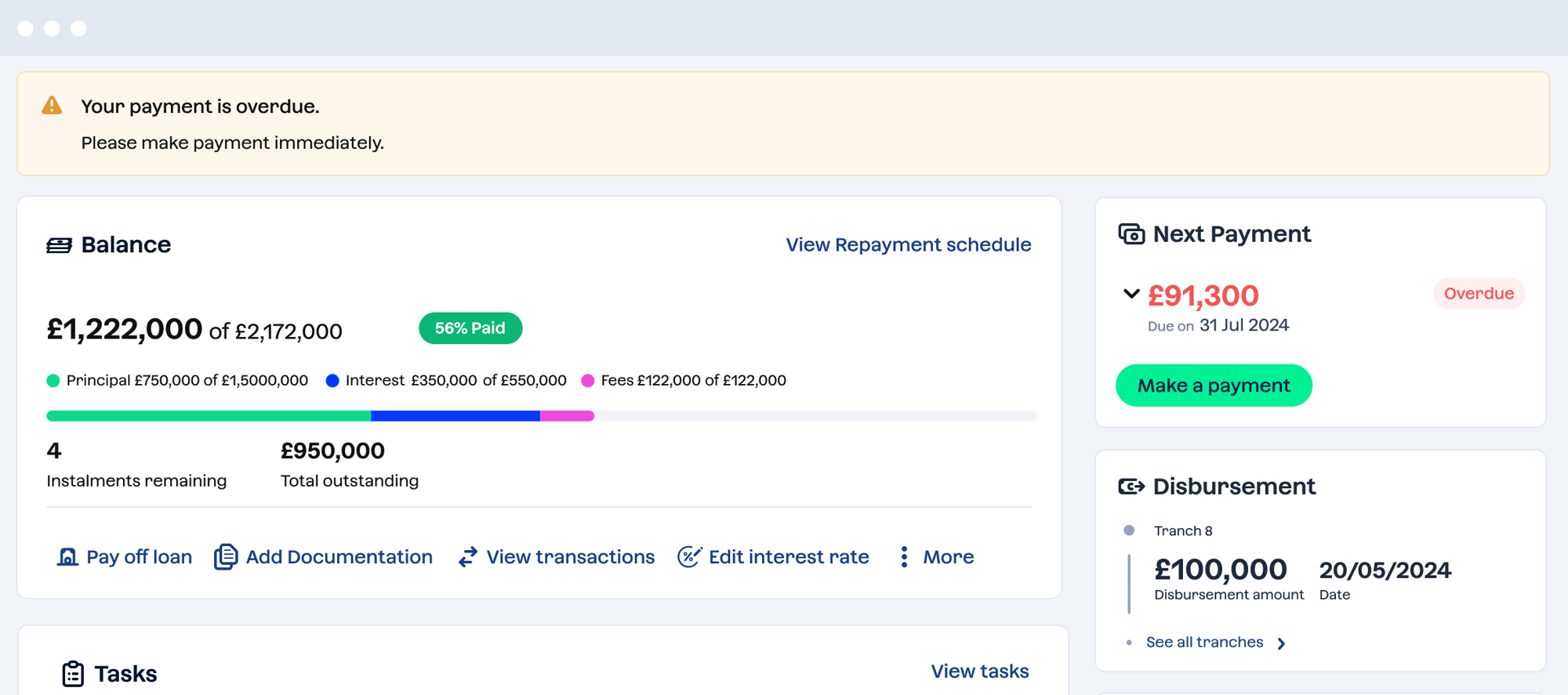

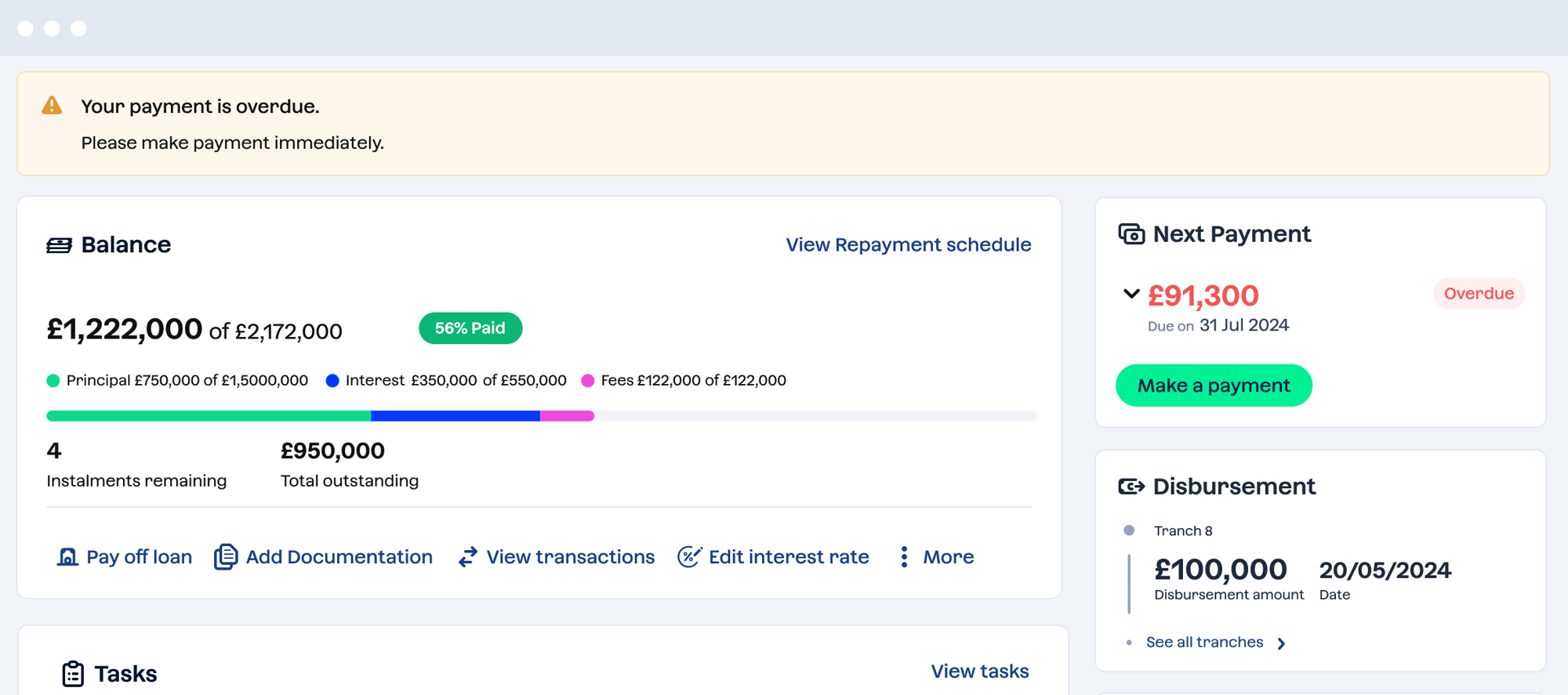

Borrower portal

- Engage borrowers through self-serviced features

- Setup your direct debit

- Easy payment tracking

- Overdue payment notifications

- Access to loan statements

FAQ

Why lenders turn to us

What is kennek?

At kennek, we are committed to revolutionizing the way lenders operate. We’re a London-based fintech with a clear mission: to remove the complexities and inefficiencies that have long troubled the non-bank lending sector. Our vertical SaaS platform simplifies every aspect of lending, from loan underwriting to monitoring and servicing, to investor reporting. With our system, lenders, borrowers, and investors have a "single point of truth," allowing for smoother operations and reduced errors. We integrate the latest API technology to ensure everything works seamlessly.

What makes kennek different?

Kennek's uniqueness lies in its integrated 'lender-in-a-box' offering, which brings together best-in-class vendors in credit scoring, open banking, data extraction, and more into a single, user-friendly platform. This innovative approach differentiates Kennek from other fintech solutions by providing a holistic system for alternative lenders and credit investors to streamline their operations and manage risk effectively.

What solutions do you offer lenders?

We offer servicing & monitoring, risk management, investor reporting, & underwriting solutions. See our solutions page for more info or get in touch now!

What are kennek's pricing plans?

We offer flexible pricing plans tailored to meet the needs of different businesses. For detailed pricing information, please visit our pricing page or contact our team today.

How do I get in touch?

Visit our contact page and fill out the form. Our team will get back to you shortly :)

Join the Movement

Discover how we can help elevate your lending business today. Reach out to learn more and start empowering your business

Contact Us