A borrower requests an extension? kennek's...

✅ Restructuring loans doesn’t need to be painful! When a borrower requests an extension — whether...

Read more27th August 2024

UK Real Estate Outpaces Europe: Key Insights for Real Estate Lenders

The UK’s commercial real estate market is rebounding faster than Europe, with a 1.4% increase in property values and a 7% rise in transaction volumes to €26bn in the first half of 2024. In contrast, Germany and France are experiencing flatter growth.

Mark Ridley, CEO of Savills, notes that the UK is "the fastest recalibrating market." However, he mentions uncertainty about "how fast and how far the recovery goes." With commercial real estate values down nearly 25% from their 2022 peak across Europe, the UK’s early gains highlight a key opportunity for strategic lending

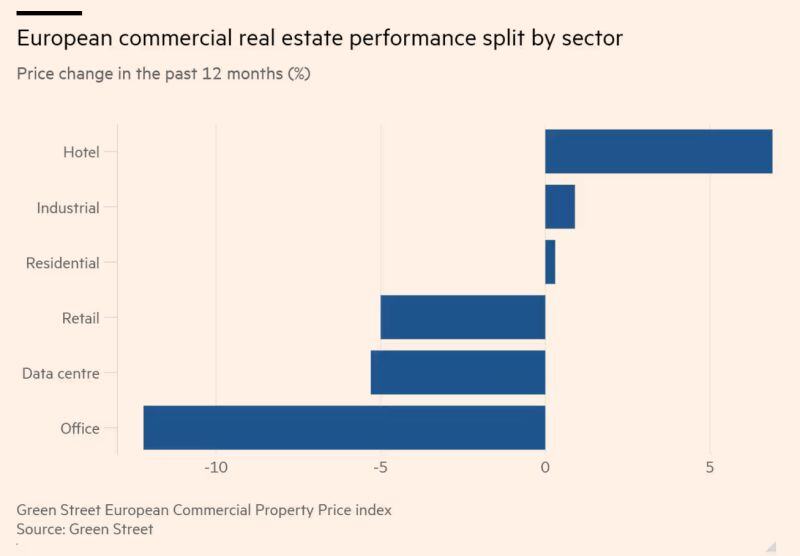

The market's recovery is uneven, with prices for warehouses, residential properties, and hotels improving, while office buildings continue to face declines. Blackstone’s significant investments in the UK, including $3bn focused on logistics, residential, and leisure, signal strong demand in these sectors

As the UK property market turns a corner, kennek's complete lending software helps lenders navigate these shifts effectively, managing risks and scaling their business

Check out the full insights from the Financial Times article.

✅ Restructuring loans doesn’t need to be painful! When a borrower requests an extension — whether...

Read more%20(3).png?width=365&name=Flexible%20loan%20engine%20(1)%20(3).png)

In today’s lending environment, relying on Excel spreadsheets and manual workflows is becoming...

Read more

In the fast-paced world of UK bridging and development finance, lenders face mounting pressure to...

Read more