A borrower requests an extension? kennek's...

✅ Restructuring loans doesn’t need to be painful! When a borrower requests an extension — whether...

Read more5th August 2024

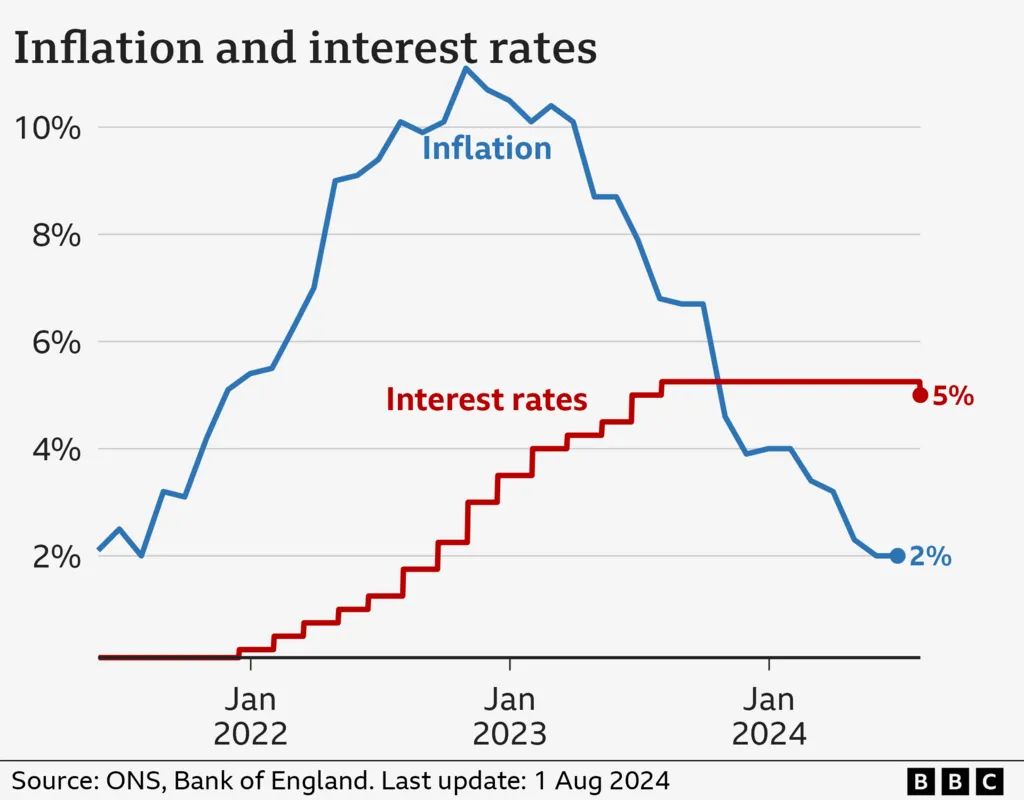

📉 The Bank of England cut interest rates for the first time from 5.25% to 5% last Thursday, in a closely-run decision, marking the first cut since the start of the pandemic in March 2020. This move aims to stimulate economic growth as inflationary pressures ease, signalling a potential shift in the UK’s financial landscape

💼 For lenders navigating these changes, kennek’s lending software offers a strategic advantage. As interest rates fluctuate, our platform provides the tools you need to manage their impacts and adapt to new market conditions seamlessly (a.o. automatic update of interest rate, loan schedule, borrower statement, payment schedule)

🚀 With the BoE’s revised growth forecasts and an improved economic outlook, there are fresh opportunities on the horizon.

With kennek to support your business by enabling efficient loan management, we help you capitalise on favourable conditions and stay ahead in a swiftly changing market

✅ Restructuring loans doesn’t need to be painful! When a borrower requests an extension — whether...

Read more%20(3).png?width=365&name=Flexible%20loan%20engine%20(1)%20(3).png)

In today’s lending environment, relying on Excel spreadsheets and manual workflows is becoming...

Read more

In the fast-paced world of UK bridging and development finance, lenders face mounting pressure to...

Read more